10 Most Expensive Movies Ever (adjusted for inflation)1

1. Pirates of the Caribbean: On Stranger Tides (2011), $422m adjusted ($378.5m budget)

2. Avengers: Age of Ultron (2015), $386m adjusted ($365m budget)

3. Pirates of the Caribbean: At World’s End (2007), $362m adjusted ($300m budget)

4. Avengers: Endgame (2019), $356m adjusted ($356m budget)

5. Avengers: Infinity War (2018), $316m adjusted ($316m budget)

6. Titanic (1997), $312m adjusted ($200m budget)

7. Spider-Man 3 (2007), $312m adjusted ($258m budget)

8. Justice League (2017), $307m adjusted ($300m budget)

9. Tangled (2010), $299m adjusted ($260m budget)

10. Harry Potter and the Half-Blood Prince (2009) $292m adjusted ($250m budget)

Since the above list is adjusted for inflation, we can see from the preponderance of relatively recent titles that Hollywood has been spending increasing amounts of money on producing blockbuster movies in the last few years.

In this article we take a look at the trends behind the increasing production costs, why these movies in particular cost so much to make, and what it might mean for the future of big-budget big-screen entertainment.

Financialisation: The Movie

Movie budgets wouldn’t be able to expand without increasing resources to pay for them, of course. The fact that almost all the movies on the list were released from 2007 onward is indicative of funding trends that emerged around that time.

Hollywood has always sought outside sources to fund its movie production, but it wasn’t until the mid-2000s that hedge funds, private equity firms and other institutional investors started sniffing around Hollywood in earnest.

During this period, Hollywood was experiencing a period of financial uncertainty; hits weren’t landing, box office returns were stagnating, and funding was becoming tight. Even Disney (in its pre-Marvel/Star Wars days) was struggling to make ends meet.

Financial institutions, however, were at that time engaged in recklessly escalating speculative pursuits – which would soon bring the global economy to its knees – and wealthy investors, laden with vast capital resources, were looking for alternative investments in order to ‘diversify their portfolios’ and ‘hedge their risk exposure’ and other exquisitely punchable phrases.

“Parkinson’s law applies [to Hollywood] as the number of projects will, regardless of quality, always expand to fully absorb the capital available.” Harold L. Vogel, Entertainment Industry Economics: A Guide for Financial Analysis

Thus, between 2005 and 2008, hedge funds are believed to have invested $4 billion in Hollywood movies, while private equity firms stumped up another $8 billion. As outlined by the above quote, this influx of money lead to an increase in production which, in turn, lead to an increase in production costs².

Though many of these investments turned sour during the subsequent turmoil of the global financial crisis, the genie was out of the bottle; and as the financial markets returned, unrepentant and unadmonished, to business as usual, they continued to fund a significant portion of Hollywood movie production³.

“The major studios have increased their domination in feature filmmaking in the financial era; the figure gets decidedly less colourful as the years go on, as independent film distributors are less able to compete with the franchise filmmaking of the major studios.” Andrew deWaard, Derivative Media: The Financialization of Film, Television, and Popular Music, 2004-2016

As deWaard’s quote suggests, it’s not just production funding that has been affected by the inexorable financialisation of Hollywood – it has also had a huge impact on the corporate structure of the industry. Like all modern corporations, the major Hollywood studios have become financial entities themselves: publicly-traded companies at the whims of the market with financial arms that engage in the full gamut of associated activities.

Thus, as in other industries, a wave of acquisitions and mergers has seen Hollywood’s production power consolidated into fewer and fewer hands. The apotheosis of this trend is, of course, Disney, which, having gobbled up Marvel, Fox, Pixar, Lucasfilm and others, no longer needs outside funding and has come to dominate the list of expensive movies as well as box offices worldwide.

Easy Money 2: Taxpayers to the Rescue

“Financialisation has led to enormous amounts of money sloshing around the higher levels of the system which, in turn, has led to, effectively, a feudal network of favours, kickbacks and sinecures … Large corporations have long depended on government support via … tax-breaks, tax-credits [and] favourable legislation … which is, effectively, a form of state-sponsored socialism for the rich.” Darren Allen, 33 Myths of the System

The Walt Disney Corporation may have more cash than Scrooge McDuck these days, but that doesn’t mean that it doesn’t take money from other sources to boost its production budgets – most notably from you and me in the guise of public handouts.

As the previous quote attests, the provision of taxpayer money to the rich is a key aspect of financialisation in late capitalism – and it’s a process which is rife within the movie industry.

The sheer scale of handouts to Hollywood from governments across the globe is staggering, and can take many forms – grants, refunds, rebates etc. All these schemes are ostensibly designed to entice movie-makers to produce films within a particular country or region in order to benefit the local economy.

Let’s not forget, however, that while many people struggle to make ends meet under government-directed austerity around the world – stoking record levels of household debt – those same governments are handing over vast sums of public money to corporations that are already enjoying record profits⁴.

For example, in 2014 Disney was handed a tidy £18.8m ($32.1m) by the British tax authorities for filming the (current) most expensive movie in history – Pirates of the Caribbean: On Stranger Tides – in the UK. However vast this rebate seems to your average taxpayer, it was merely a drop in the Caribbean Sea compared to the $1 billion that this terrible, terrible movie went on to rake in at box offices worldwide.

While it can be argued, with some merit, that such programmes do create jobs and boost local economies, they are also hugely corrupt processes that are open to all the usual abuses, loopholes and dubious special treatments that characterise most financial dealings between governments and big business.

Some of these dubious practices are predictable – e.g. producers padding budgets to recoup more money. Others, though not necessarily illegal, are more unexpected – such as RBS weaselling itself billions of pounds worth of tax breaks, or Hollywood’s roaring tax credit trade which allows US corporations in other industries to avoid even more taxes.

This all adds up to another factor in the increasing costs of Hollywood movies – as public money is hoovered up to, legitimately and illegitimately, inflate production budgets.

The Return of the Profits

So, the financialisation of Hollywood has made increasing amounts of money available for production budgets over the last 15 years. But what, aside from investment diversification and tax dodging, is enticing investors to dig deeper into their pockets year after year?

Since we’re discussing a corporate capitalist industry, not an M. Night Shyamalan movie, the answer is, predictably, ‘increasing financial returns’.

Not that it’s been a simple upward trajectory on the profits front over the last couple of decades, as the film industry has been beset by technological and social developments that have seen cinema attendance plummet. Battling against the proliferation of home entertainment formats and the subsequent streaming revolution, the industry has clung onto financial viability by increasing ticket prices and introducing various unnecessary add-on costs (e.g. 3D glasses surcharges or Odeon’s shameless ‘blockbuster fee‘). Such tactics were merely supporting actors to the industry’s real financial star, however: the growing global market.

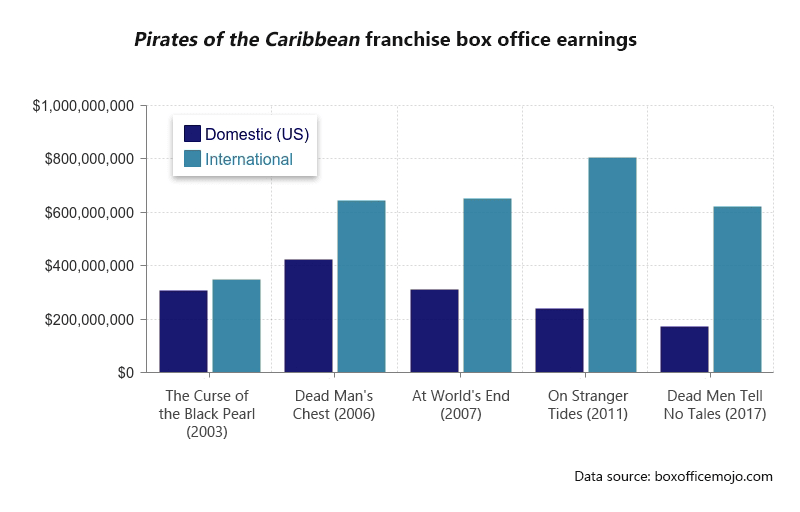

The box office takings of Pirates of the Caribbean series clearly demonstrate how important international cinema audiences have become to Hollywood’s bottom line. As we can see in the graph below, international takings have risen even as domestic (US) earnings have walked off a plank. Thus, while critics and audiences at home complain of that most voguish of afflictions – ‘franchise fatigue’ – the films’ creators unabashedly continue investing huge sums of money into each entry in pursuit of global revenues.

With a broader global audience now making up for any shortfall in domestic revenues, the potential returns available to Hollywood are huge. For example, the recent Avengers: Endgame currently stands as the highest grossing movie of all time with worldwide box office takings of over $2.8 billion (not a bad return on an outlay of $365 million). Likewise, Disney broke its previous record for total annual global box office revenues by June of this year and is now predicted to top a colossal $11 billion by the end of 2019.

In such a crowded market, however, today’s movies need to be backed by big bucks to have a chance of reaping such enormous profits. If we look at the top grossing movies of all time, adjusted for inflation, for example, we can see that it is not dominated by recent films at all – and the only modern titles that do hit such heady heights are ones with the kinds of eye-watering budgets under discussion.

Highest-grossing films as of 2019 adjusted for inflation⁵

- Gone with the Wind (1939) – $3,728,000,000

- Avatar (2009) – $3,273,000,000

- Titanic (1997) – $3,099,000,000

- Star Wars (1977) $3,061,000,000

- Avengers: Endgame (2019) – $2,798,000,000

- The Sound of Music (1965) – $2,564,000,000

- E.T. (1982) – $2,503,000,000

- The Ten Commandments (1956) – $2,370,000,000

- Doctor Zhivago (1965) – $2,246,000,000

- Star Wars: The Force Awakens (2015) – $2,215,000,000

This list shows that only very costly modern productions can match history’s most profitable movies. Avatar, Titanic, Avengers: Endgame and Star Wars: The Force Awakens are, respectively, currently the 14th, 6th, 4th and 17th most expensive movies ever (when adjusted for inflation), while the older movies on the list cost peanuts by comparison⁶. Enormous box office returns are clearly out there to be had, it’s just that they now take increasing amounts of investment to attain⁷.

That’s not to say that a big production budget guarantees massive returns, of course⁸. Rather, it’s that, nowadays, only mega-budget movies have the possibility of reaping the massive rewards that were once attainable by more modest productions.

Thus, Hollywood corporations are trapped in an all-consuming cycle, pumping ever more money into movie budgets in the hopes of growing global revenues and earning record profits.

In the next section we’ll look at how the industry has been exploiting the mass-market appeal of movie franchises to this end, and how that process is, in itself, inflating production budgets and the subsequent necessity for ever-growing financial returns.

Risk Aversion: The Series

As the level of financialisation has increased in Hollywood, so too has its fear of the evil baddie of the financial markets: risk. This has ultimately resulted in the growing homogenisation of content within big budget projects.

Movie studios have always liked a sure-thing, of course, and so derivative, tried-and-tested formulas have been a cinematic staple from the industry’s birth. Historically, however, sequels were usually cheap, quick cash-ins designed to squeeze a little extra profit off the back of a successful movie from a ready-made, receptive audience. Although it wasn’t until the advent of the summer blockbuster franchise during the 70s and 80s that Hollywood realised the true financial potential of calculated sequelisation.

A cursory glance at the current most expensive movies suggests that this phenomenon has reached new heights – and originality new lows – with franchises now forming the bloated core of Hollywood’s output.

Of the ten movies in the list, eight are sequels or spin-offs from established series – most of which were already adapted from other types of media⁹. We can see, therefore, that Hollywood now puts more financial resources into sequels and franchises than ever before in the hope of vast returns from global audiences.

In chasing big returns via these supposedly risk-averse propositions, however, the industry has become stuck in a financial feedback loop in which each successive franchise entry costs more to produce.

The crux of this problem is that these movies are the epitome of the modern consumer spectacle; and, the laws of the system state that spectacle, like entropy or GDP, must always increase… forever.

This means that, in order to meet audience/shareholder/investor expectations, every successive movie needs to be ‘bigger’ and ‘better’. As studios compete with each other and their own previous year’s revenue figures in order to keep the ticket sales/share prices up, this invariably results in an annual arms race of:

- ‘Bigger/better’ action sequences

- ‘Bigger/better’ CGI technology

- ‘Bigger/better’ ensemble casts

- ‘Bigger/better’ stars

- ‘Bigger/better’ running times

- ‘Bigger/better’ sets

- ‘Bigger/better’ exotic locations

- ‘Bigger/better’ marketing campaigns ‘synergised’ across ever more mediums

Some of these elements may not necessarily represent significantly increased expenditure, and some may be offset by cost-cutting techniques such as reusing assets or filming sequels back-to-back, but many will inevitably have an exponential impact on costs¹⁰.

“Honestly, the closest I can think of [Marvel movies], as well-made as they are, with actors doing the best they can under the circumstances, is theme parks. It isn’t the cinema of human beings trying to convey emotional, psychological experiences to another human being.” Martin Scorsese, interview with Empire Online

Occupying three of the top five positions, the Avengers series epitomises these issues. Escalating costs are hard to avoid when you factor in an ever-growing roster of superheroes played by stars whose fame, and price tags, increase with each successive movie, for example. What’s more, as the various threads of the Marvel comics have converged into cinematic superhero orgies, they’ve had to pay out a growing group of increasingly well-paid actors to all appear together in the same films. Thus, with no chance of an Iron Man chamber piece making it to the big screen, the Avengers’ domination of the list of most expensive movies was always a structural inevitability.

Hollywood Originality: Endgame?

To sum up, the story behind the most expensive movies of all time is that financialisation has provided an influx of funds, growing global audiences have increased possible returns, and increasingly expensive yet (supposedly) risk-averse franchise movies have become the favoured method to attain them.

The by-product of this is the homogenisation of cinematic output; an avalanche of derivative superheroes and franchise sequels that are stifling creativity and crowding out smaller movies.

Viewed from this angle, like a Hollywood gumshoe of old, we could view these processes as the means (movie franchises), motive (global revenues) and opportunity (financialisation) of the killing of cinematic originality.

As with all economic processes, at some point the bubble will burst – due to audience backlash, or another global financial crisis, or perhaps the rise of an even more profitable cinematic trend.

Until that point, we can expect the continuation of this cycle with more spandex-clad movie stars, record-breaking profits, and new milestones in exorbitant production budgets.

Notes

1. Source: Wikipedia

2. 2007, the last year that the MPAA released annual figures on industry production costs, saw the first significant increase in four years.

3. The level of corruption and opportunity for financial crime in all these funding processes should not be overlooked. Tax evasion, fraud and money laundering have long been part of the Hollywood financial landscape.

4. All while maintaining – erroneously – that public spending must be cut in order to ‘balance the budget’.

5. Source: Wikipedia

6. Gone with the Wind’s $3.9 million budget in 1939 amounts to a mere $72.2 million in today’s money, for example.

7. The decline in the rate of return-on-investment here echoes that of wider downward trends of late stage capitalism, not only in the global economy but even within the processes of energy production on which it inextricably relies.

8. The 8th most expensive movie on our list, Justice League, ‘underperformed’ by most accounts, for example, earning a mere $658m worldwide – or just over a quarter of the box office total of Avengers: Endgame.

9. Not that the two outliers are wildly original flights of fancy either, one being based on an infamous historical event and the other a traditional fairy tale.

10. The ‘non-franchise’ most expensive movies also fall foul of the cost of spectacle – see Titanic’s replica film set (rumoured to have made up three quarters of the budget and Tangled’s ‘revolutionary’ CGI hair technology.

Dive even deeper

NerdWallet UK Survey: Retirement and Emergency Funds are the Most Popular Savings Goals

New research by NerdWallet UK reveals that a majority of UK adults have clear savings goals and are taking action to reach them.

UK Lifestyle Debt Worries Statistics

Almost a third of UK adults feel pressure to spend more than they can afford, using credit cards, loans or overdrafts. New research shows that debt worries still affect those earning above the average salary.

Childcare Funding is Changing This Year: Make Sure Your Family Doesn’t Miss Out

The government’s Childcare Choices scheme is expanding, so more families stand to benefit from 15 or 30 hours funded childcare. But accessing what you’re entitled to isn’t always straightforward. We explain how to claim what you’re eligible for.